Many homeowners ask a smart and increasingly relevant question: If I borrow money at mortgage rates, should I park it in an offset account or invest it in something like the S&P 500? In this post, we break down this exact question using real numbers, tax assumptions, and long-term projections to help you make an informed choice.

The Two Scenarios

Let’s assume you borrow $120,000 at 6% interest and consider two options:

🔃 Scenario 1: Place the $120,000 in a Home Loan Offset Account

- You pay 6% interest on the borrowed $120,000 = $7,200 per year

- You save 6% interest on your home loan via the offset = $7,200 per year

- Result: Net cash flow = $0

Because the amount you’re paying and saving are equal, this strategy is financially neutral. There’s no compounding benefit and no loss—just status quo, and it offers peace of mind due to its low risk and the presence of a cash buffer.

📈 Scenario 2: Invest the $120,000 in the S&P 500 (U.S. stock market index)

- You still pay 6% interest, but in this case, the loan is for investment purposes, so the interest is tax-deductible.

- Your marginal tax rate is 32%, reducing your after-tax interest cost to:

6% x (1-0.32) = 4.08%

- Assume average S&P 500 returns of 10% and 12%, including dividends

- Net returns:

- At 10% return: 10% – 4.08% = 5.92%

- At 12% return: 12% – 4.08% = 7.92%

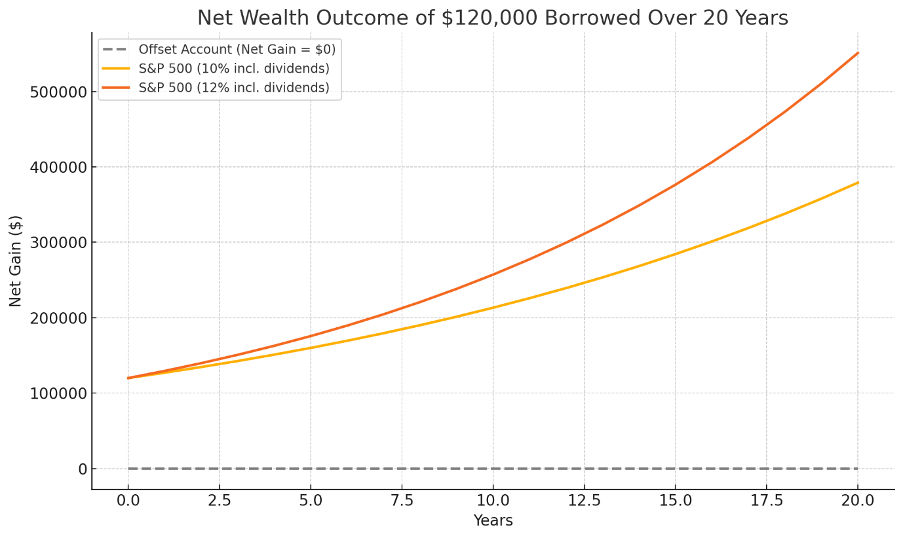

20-Year Wealth Projection

We now project the outcomes over a 20-year period.

| Scenario | Net Annual Return | Future Value (After 20 Years) |

| Offset Account | 0% | $0 gain |

| S&P 500 @ 10% | 5.92% | ~$379,440 |

| S&P 500 @ 12% | 7.92% | ~$552,480 |

🌎 What This Means:

- Borrowing to use an offset account is neutral in terms of wealth creation (since you’re saving exactly what you’re paying in interest)

- Investing borrowed funds in the S&P 500 can create significant long-term wealth, if markets deliver historical returns and you can stomach the volatility

- The tax deductibility of investment loan interest gives a strong tailwind to the investment strategy

Visualising the Difference

Here’s a chart showing the difference between the three approaches:

Final Thoughts

If you are highly risk-averse and prioritise stability, the offset strategy gives you peace of mind with no net cost. But if you are comfortable with market fluctuations and have a long investment horizon, borrowing to invest in a diversified index like the S&P 500 can significantly boost your net wealth—especially when you factor in the tax-deductible nature of the loan interest.

Make sure to review your own risk tolerance, time horizon, and tax circumstances before deciding. And as always, speak with a financial adviser or tax professional to ensure this fits within your personal strategy.

Disclaimer: This content is for educational purposes only and does not constitute personal financial, tax, or legal advice. Please seek professional advice tailored to your personal circumstances from a qualified financial adviser, accountant, or solicitor.

Leave a comment