In the ever-evolving landscape of finance, dividends play a pivotal role, providing investors with a consistent stream of income while contributing to the overall growth of their investment portfolio. This comprehensive guide delves into the intricacies of dividends, their significance in Australia, and how they can be harnessed to create a dependable passive income stream.

Understanding Dividends: Dividends signify a distribution of a portion of a company’s earnings to its shareholders. They represent a tangible reward for investing in a specific company and are typically disbursed in the form of cash or additional shares.

Dividend Payment Frequency in Australia: Companies in Australia adhere to various schedules for dividend payments. While some businesses offer dividends semi-annually or quarterly, others may opt for an annual distribution. This flexibility empowers investors to select investments that align with their income requirements and financial objectives.

Dividend Yield: Dividend yield stands as a critical metric that gauges the annual dividend income an investor can anticipate relative to the current market price of a stock. It serves as a tool for comparing distinct dividend-paying investments. These days, investors can effortlessly check a company’s historical dividend yield. For instance, by visiting the Australian Stock Exchange website and searching for the listed company, you can access the company’s distribution history and its current dividend yield. At the time of writing, CBA, for example, boasts an annual dividend yield of 4.31%.

Consistency in Bluechip Dividends: Bluechip companies, renowned for their stability and robust financial performance, consistently provide dividends. Here are some examples of the leading blue-chip companies in Australia, ranked by market capitalisation:

- BHP Group Ltd (ASX: BHP)

- Commonwealth Bank of Australia (ASX: CBA)

- CSL Ltd (ASX: CSL)

- National Australia Bank Ltd (ASX: NAB)

- Westpac Banking Corporation (ASX: WBC)

- Macquarie Group Ltd (ASX: MQG)

- Australia and New Zealand Banking Group Ltd (ASX: ANZ)

- Woodside Energy Group Ltd (ASX: WDS)

- Fortescue Metals Group Ltd (ASX: FMG)

- Wesfarmers Ltd (ASX: WES)

Cash Dividends vs. Dividend Reinvestment Plans (DRPs): Companies offer two primary options for dividend payments: cash dividends and Dividend Reinvestment Plans (DRPs). Cash dividends provide immediate income, while DRPs allow shareholders to reinvest dividends by purchasing additional shares.

What Is Dividend Reinvestment? Dividend reinvestment involves using dividends to acquire additional shares instead of receiving cash. This strategy offers several advantages:

- Low costs: Reinvestment is automatic, eliminating commissions or brokerage fees when acquiring more shares.

- Dollar cost averaging: Regular shares are purchased with each dividend, facilitating dollar-cost averaging and helping to average entry prices over time.

- Compounding power: Reinvested dividends lead to compounding, enhancing long-term returns. More shares are purchased with dividends, resulting in higher dividends in the future and a cycle of growth.

Cash Dividends: Opting for cash dividends is suitable when income is needed to cover lifestyle expenses. Alternatively, cash can be utilized to diversify one’s portfolio into other investment options, especially if changes in the company’s circumstances warrant reevaluation.

Imputation System in Australia: Australia’s imputation system prevents double taxation of dividends by allowing companies to attach franking credits to dividends. Franking credits represent taxes already paid by the company on its profits. A fully franked dividend, for instance, includes both the $70 dividend and $30 in franking credits, totaling $100 ($70 fully franked dividends and $30 franking credits, which represent taxes paid by the company). The taxpayer (investor) calculates taxes as follows:

Dividends received: $70.

Franking credits received: $30.

Total taxable income: $100.

Taxes on taxable income: 0.47 * $100 = $47.

(Assuming a top marginal tax rate of 45% plus a 2% Medicare levy)

Minus franking tax offset: $30.

Taxes payable: $17.

What if you are not an Australian resident for tax purposes?

Dividends paid or credited to non-resident shareholders. Non-resident individuals can also be paid or credited franked dividends or unfranked dividends from Australian resident companies. However, they are taxed differently from resident shareholders.

Franked dividends

If you are a non-resident of Australia, the franked amount of dividends you are paid or credited are not subject to Australian income and withholding taxes. The unfranked amount will be subject to withholding tax. However, you are not entitled to any franking tax offset for franked dividends. You cannot use any franking credit attached to franked dividends to reduce the amount of tax payable on other Australian income and you cannot get a refund of the franking credit. You should not include the amount of any franked dividend or any franking credit on your Australian tax return.

Unfranked dividends

The other type of dividend a resident company may pay or credit to you is an unfranked dividend. There is no franking credit attached to these dividends.

The whole or a portion of an unfranked dividend may be declared to be conduit foreign income on your dividend statement. To the extent that the unfranked dividend is declared to be conduit foreign income, it is not assessable income and is exempt from withholding tax

Any other unfranked dividends paid or credited to a non-resident are subject to a final withholding tax.

(ATO 2023).

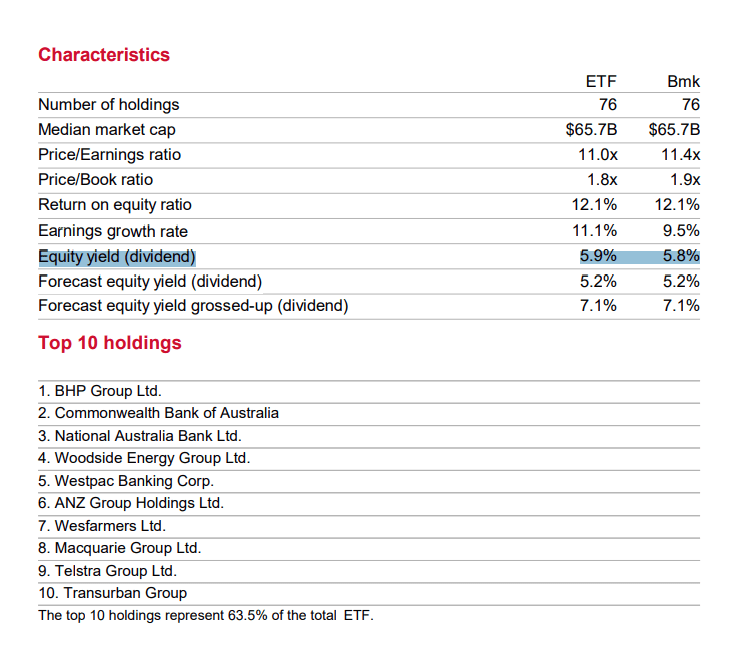

Establishing a Dividend Income Stream: While blue-chip companies might not experience rapid share price growth, their consistent dividends offer stability. Investing in these companies can establish a dependable dividend income stream. Alternatively, investors averse to individual stock investments can consider dividend ETFs. Vanguard Australian Shares High Yield ETF (VHY), for instance, is a cost-effective ETF providing exposure to large dividend-paying Australian companies. As of June 30, 2023, this ETF boasted an equity yield of 5.9%.

Navigating High-Interest Rate Environments: In periods of high interest rates, fixed-interest products might seem appealing due to potential high returns and minimal risk. However, dividend investing offers distinct advantages, including franking credits and potential capital gains. As interest rates fluctuate, dividend investing remains a viable long-term strategy.

Dividends stand as a beacon of financial stability, offering investors both consistent income and the potential for capital appreciation. Through a thoughtful approach to dividend investing, individuals can construct a resilient and diversified portfolio capable of navigating evolving economic landscapes, ensuring a prosperous future.

Disclaimer: The content provided in this article is intended for educational purposes only and should not be construed as financial advice. It is not a substitute for professional guidance and readers are strongly encouraged to consult with a qualified financial advisor or investment professional before making any financial decisions. The information presented here is based on general knowledge and may not reflect the most current market conditions or regulations. The authors and publishers of this article are not responsible for any actions taken based on the information provided herein.

Leave a comment